Latest posts

-

☕️ The Hidden Cost of Coffee Tariffs

As a big coffee drinker, I notice when prices shift—and lately, I’ve been thinking a lot about how trade policy affects my daily brew. A 50% tariff on Brazilian coffee might sound like a blow to unfair competition, but let me tell you: it’s your wallet that ends up paying the price. And much of

-

The Broken Logic of Tax Cliffs

The U.S. tax code is full of contradictions, but few are as absurd—or as damaging—as the so-called cliff effects. These are moments where earning just a few extra dollars can cause your taxes or benefit losses to spike so sharply that your net income actually drops. With the new 2025 House tax proposal—nicknamed the “Big

-

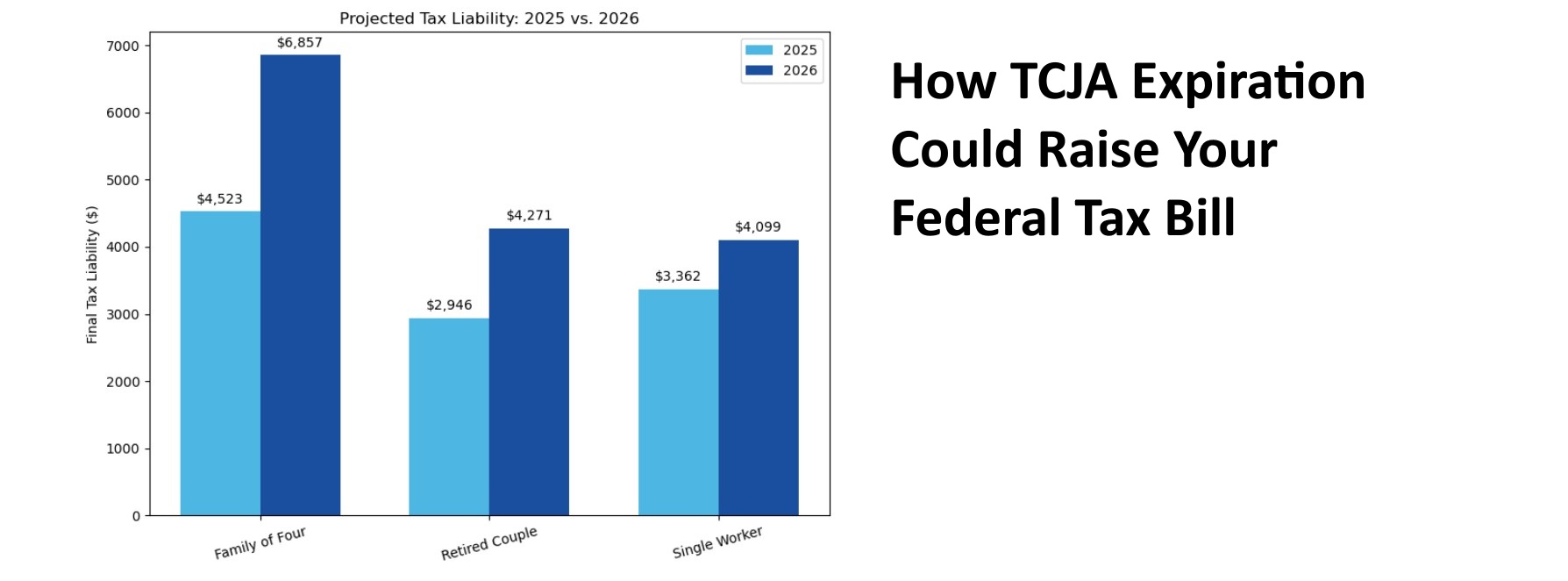

Will Your Taxes Go Up in 2026?

The Tax Cuts and Jobs Act (TCJA) is set to expire at the end of 2025. If Congress doesn’t act, many of the tax reforms that have defined the last decade — including lower brackets, a larger standard deduction, and expanded tax credits — will sunset. Tax rules will revert to their pre-2018 form starting

-

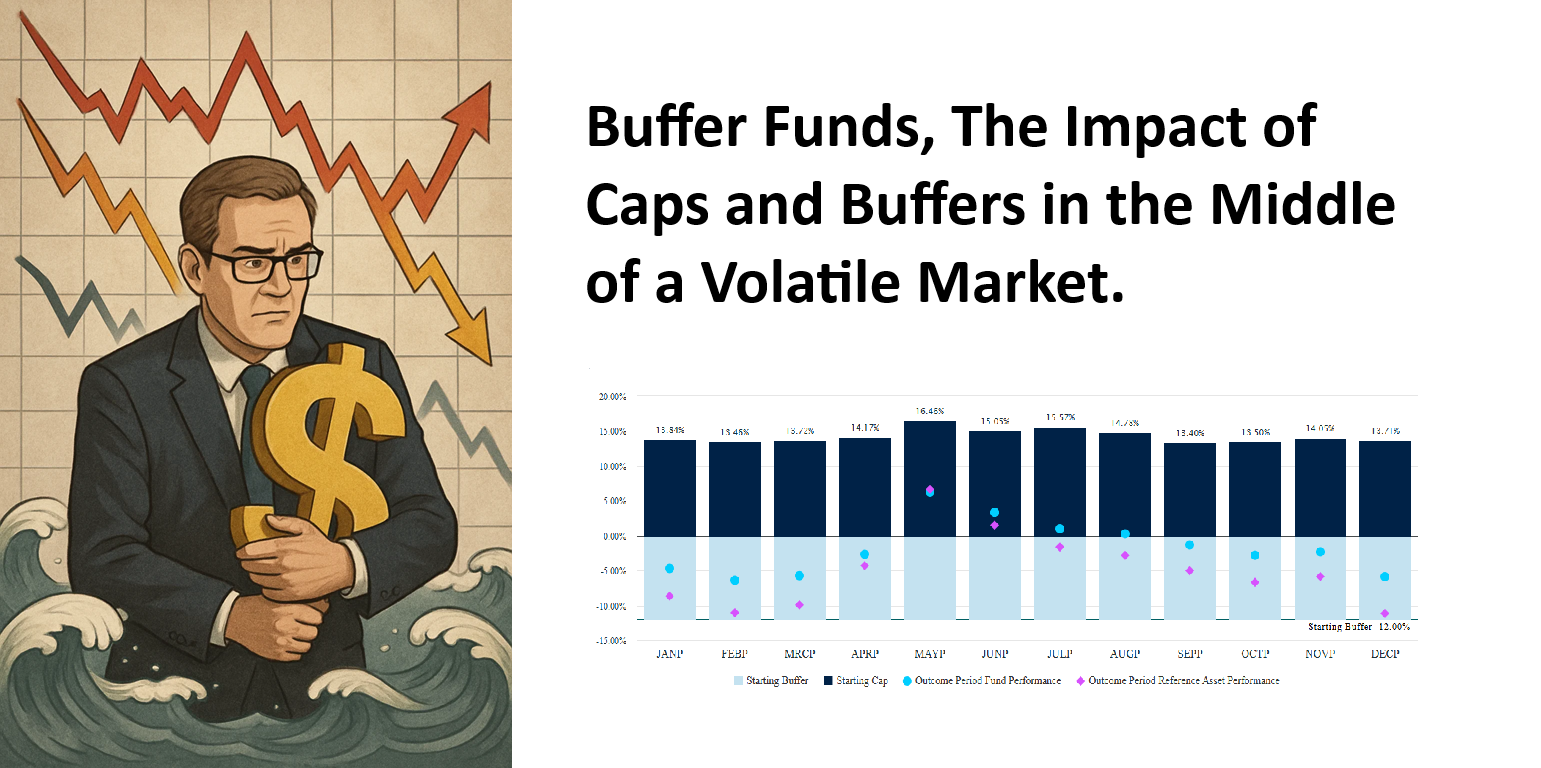

Can Buffer ETFs Protect You in a Down Market? PGIM Fund Review

In today’s uncertain and volatile market, investors are searching for ways to stay invested in equities while limiting downside risk. Traditional approaches—like low-volatility ETFs or structured hedging strategies—can help reduce drawdowns, but they often come with trade-offs: muted upside, complex option overlays, or high costs. This is where buffer ETFs, and in particular laddered buffer

-

A Detailed ROI Analysis for a 10kW Solar System

Introduction Investing in solar power is a major financial decision that requires careful evaluation of costs, savings, and return on investment. A 10kW solar system is a reasonable size system for many homeowners seeking energy independence and long-term savings. I live in a fairly energy efficient home. This article explores the financial implications of installing

-

Buffer Funds, An Alternative to Make Risk Management Easy

The traditional approach to risk management for regular investors is to use an equity/bond mix, such as the 60/40 portfolio—60% equities and 40% bonds. This has long been the go-to strategy for investors seeking a balance between growth and risk mitigation. The “age in bonds” rule—allocating a percentage of your portfolio to bonds equal to