Introduction

Investing in solar power is a major financial decision that requires careful evaluation of costs, savings, and return on investment. A 10kW solar system is a reasonable size system for many homeowners seeking energy independence and long-term savings. I live in a fairly energy efficient home. This article explores the financial implications of installing such a system, considering installation costs, financing, maintenance, and estimates the Internal Rate of Return (IRR) under different scenarios.

Assumptions

To evaluate the economic feasibility of a 10kW solar installation, we tested the following assumptions:

- System Cost: $30,000 before and $21,000 after tax incentives.

- Annual Electricity Production: 12,000 kWh (Assumes a roof suitable for solar with good sun exposure)

- Electricity cost: $0.15/kwh or $0.2/kwh, corresponding to $1,800 and $2,400 per year in electricity cost.

- Interest Rate: 6% or 7% interest rate

- Loan Term: 15 years

- Percent Financed: 0%, 50% or 80%

- Cash Flow Analysis Period: 25 years

- Major Maintenance Cost: $4,000 inverter replacement after 15 years.

- Net Metering: Full credit for excess energy fed into the grid

We will assess the IRR under various electricity cost, tax brackets, and financing percentage scenarios.

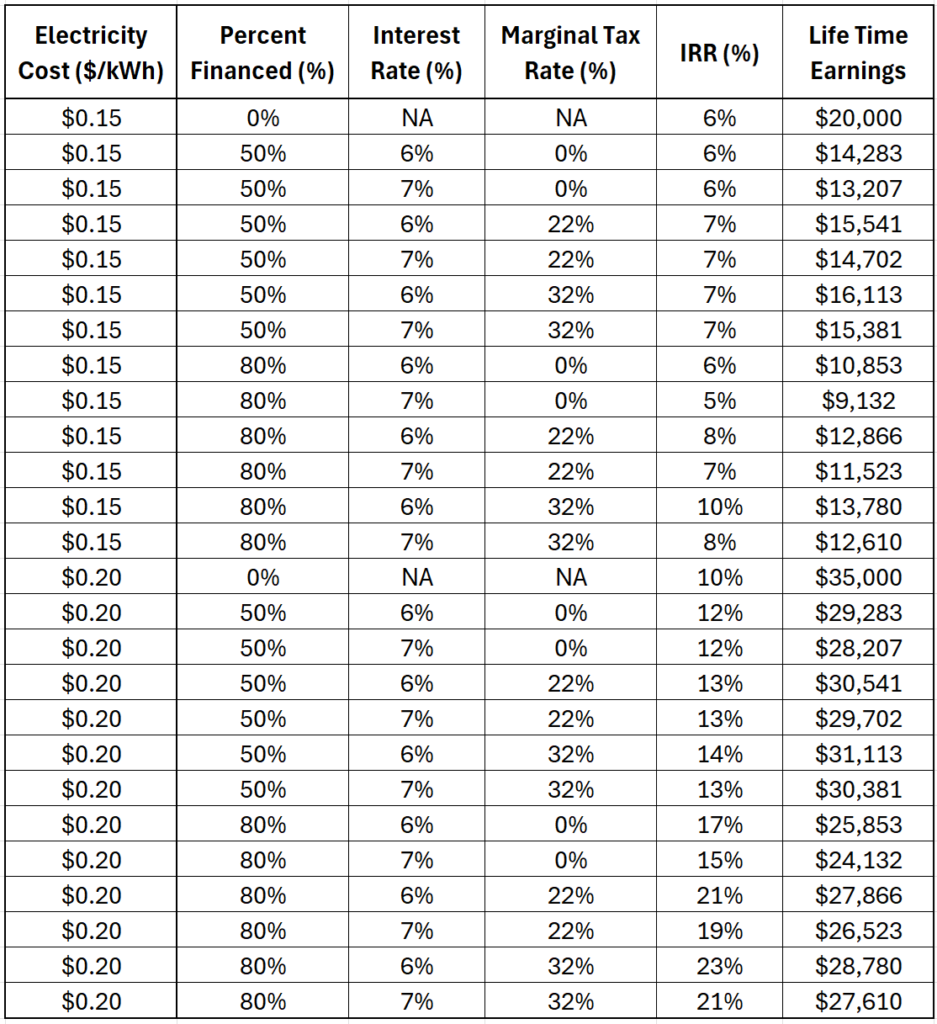

IRR Analysis: Evaluating Returns on Investment

The Internal Rate of Return (IRR) measures the financial viability of the solar investment, factoring in upfront cost, financing, maintenance, and savings over time. In this analysis percent financed assumes we only finance the cost after tax incentives. The time it takes to actually get the tax incentives have not been taken into account.

Key Takeaways from IRR Analysis

- Electricity rates have a significant impact on IRR: When electricity costs $0.20/kWh, IRR significantly improves, reaching up to 23% with 80% financing for people in a high tax bracket.

- Financing boosts IRR: Borrowing a portion of the cost improves IRR due to leverage. An 80% financed system has a better return than paying in cash, especially at higher electricity costs.

- Higher tax brackets improve returns: Households in the 30% tax bracket benefit more from tax deductions related to the interest payments.

- Overall returns are relatively attractive, especially considering that these returns are tax free and low risk.

- You can also run your own analysis with our Solar IRR calculator. Notice that the setup of the Solar IRR calculator is a bit different, with percent financed based on the full installation costs and the tax incentive accounted for as a positive cash flow in year 2. This is a bit more accurate as it accounts for the delay of getting the tax incentive.

Additional Considerations That Impact Returns

1. Potential Increase in Homeowners Insurance

Installing solar panels may slightly increase homeowners’ insurance premiums because they add value to the property, increasing replacement costs. However, the increase is typically modest, often amounting to only a few extra dollars per month. It’s advisable to check with your insurance provider to ensure the solar system is adequately covered under the policy without excessive premium hikes.

2. Boosting Returns with Solar Renewable Energy Certificates (SRECs)

In some states, homeowners can sell Solar Renewable Energy Certificates (SRECs) to utility companies needing to meet renewable energy targets. Each SREC represents 1 MWh of electricity generated. A 10kW system producing 12 MWh annually would generate 12 SRECs per year, which could be sold for additional revenue. The value of SRECs varies by state and demand. If available, SRECs can significantly boost the financial return of a solar investment.

3. Hedge Against Inflation and Rising Electricity Costs

One of the most overlooked benefits of solar energy is that it provides a hedge against inflation. Over time, electricity prices tend to rise due to inflation, fuel costs, and infrastructure expenses. With solar panels, homeowners lock in their electricity costs, reducing exposure to future price hikes. This makes solar a long-term financial safeguard against unpredictable energy markets.

4. The Impact of States Without Net Metering

Net metering allows homeowners to receive credit for excess electricity sent back to the grid. Without net metering, utilities may buy excess solar power at a much lower rate, reducing overall savings and increasing the payback period.

States Without Net Metering

As of recent data, states like Alabama, South Dakota, and Tennessee do not have mandatory net metering policies. Instead, utilities in these states may offer alternative compensation mechanisms, but they often pay less than retail rates for excess electricity. Without net metering, solar savings could be reduced by up to 50%, making it essential to research state-specific policies before investing in solar.

5. The Cost and Considerations of Backup Batteries

Many homeowners considering solar energy also explore backup battery storage to provide electricity during power outages or at night. While batteries offer energy resilience, they are expensive, often adding $10,000–$15,000 to the total system cost. Unlike solar panels, batteries typically do not offer a strong financial return, as they do not directly generate additional electricity or increase net metering benefits. However, in areas prone to frequent power outages—such as regions affected by hurricanes, wildfires, or unreliable grids—a solar-plus-battery system can provide peace of mind and keep essential appliances running. For most homeowners with reliable grid power, the high cost and long payback period make battery storage less financially attractive unless there are significant incentives or time-of-use electricity pricing that justifies the investment. In a future blog I will look at the cost of adding a backup battery vs installing a standby generator.

Conclusion: Is a 10kW Solar System Worth It?

A 10kW solar installation can provide long-term financial benefits, particularly in areas with higher electricity costs, net metering policies, and SREC markets.

- Best case scenario: Homeowners in a high tax bracket (30%) with 80% financing and $0.20/kWh electricity rates achieve IRRs above 20%—a highly attractive return.

- Moderate case: A cash purchase in a 20% tax bracket with $0.15/kWh rates delivers a 6-7% return, comparable to conservative investments.

- Worst case scenario: If electricity rates drop or financing costs rise, IRR may decline. Returns also diminish in states without net metering.

Final Thoughts

While a 10kW solar system is a strong investment, factors like insurance costs, SRECs, inflation protection, and net metering policies significantly influence financial outcomes. Understanding state regulations and incentive programs is crucial to maximizing your return on investment.

2 responses to “A Detailed ROI Analysis for a 10kW Solar System”

-

Your writing doesn’t just explain things; it transforms the way we see and understand the world around us.

-

Thanks. That is very kind of you to say.

-

Leave a Reply