In today’s uncertain and volatile market, investors are searching for ways to stay invested in equities while limiting downside risk. Traditional approaches—like low-volatility ETFs or structured hedging strategies—can help reduce drawdowns, but they often come with trade-offs: muted upside, complex option overlays, or high costs.

This is where buffer ETFs, and in particular laddered buffer ETFs, offer a compelling alternative. PGIM has taken the lead in this space with its laddered suite, including two standout funds:

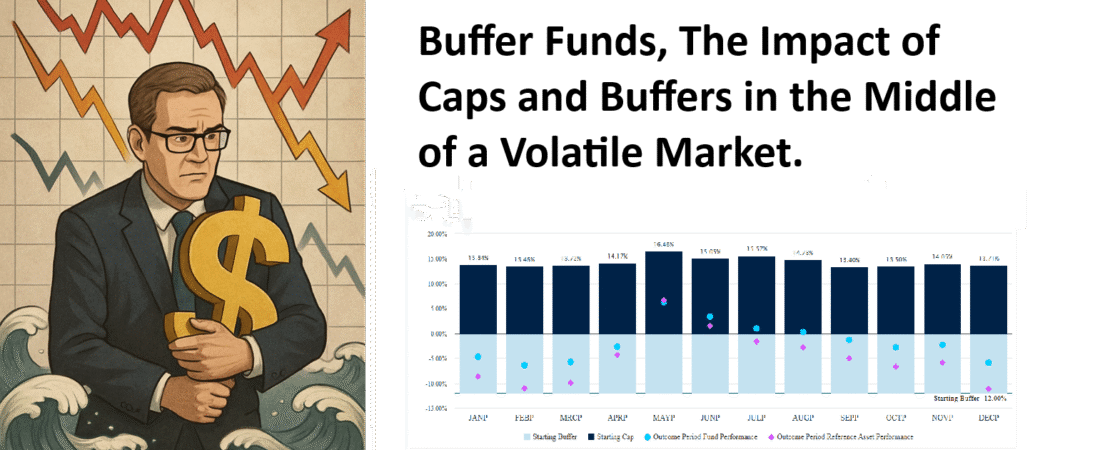

These ETFs invest across 12 monthly “sub-funds,” each with a one-year outcome period and a built-in downside buffer. The “12” and “20” in the fund names refer to the size of this protection — meaning that, over a full holding period, if the S&P 500 drops no more than 12% (BUFP) or 20% (PBFR), investors should avoid losses (aside from the modest management fee).

Unlike traditional low-volatility funds, which aim to reduce fluctuations by tilting toward stable sectors, buffer ETFs explicitly define their protection range and cap, offering a more predictable framework for managing equity risk. And unlike custom hedging, they don’t require constant monitoring or rolling options — the structure is embedded in the ETF itself. For more on buffer funds also see my earlier post on the subject.

However, in a volatile environment — especially one following a significant market decline — it becomes critical to understand what you’re actually buying when entering a laddered buffer ETF mid-cycle. This article explores a structured way to evaluate the current protection, upside potential, and likely return profiles based on the fund’s real-time structure.

🔍 What Makes Laddered Buffer Funds Unique?

Each month, a new buffer ETF with a one-year term is added to the fund, and one rolls off, creating a laddered portfolio. This means at any point in time, the laddered fund holds tranches that are at various points in their outcome periods — some just started, others nearing completion.

For an individual buffer ETF, the expected return is relatively straightforward to estimate, especially if you buy it right at the beginning of its outcome period. You just need:

- The cap (maximum gain)

- The buffer (protected downside)

- The current index level relative to the level at the start of the outcome period

However, in a laddered structure, estimating the return of the combined 12 tranches is more complex.

📊 Modeling Future Performance: A Stylized Scenario

To create a simplified but insightful estimate, I modeled each fund’s return assuming that:

The S&P 500 immediately changes by a specified amount (from -20% to +20%) and then remains at that level for the entire 12-month period.

While this is clearly not how markets behave in reality, it allows us to get a reasonable understanding of the risk and potential the fund offers in a single snapshot if today’s index level were the ending level for each of the 12 sub-funds over their remaining holding periods. The actual return would also be significantly impacted by the gains and drops in the market relative to when the different funds outcome periods expire.

The analysis uses PGIM’s published data on remaining caps and buffers as of 2025-04-22 for each monthly sub-fund to calculate the resulting 12-month return under each market scenario. At the end of the blog after the comments is a table with this analysis that I plan to update on a regular basis to reflect the current state of the funds.

📈 Results: Estimated 12-Month Returns

| Index Return (SP500) relative to 2025/04/22 | BUFP (12% Buffer) | PBFR (20% Buffer) |

|---|---|---|

| -20% | -12.35% | -5.89% |

| -10% | -2.98% | +0.37% |

| -5% | +0.69% | +0.89% |

| 0% | +2.83% | +1.30% |

| +5% | +3.88% | +2.35% |

| +10% | +6.37% | +4.87% |

| +20% | +14.60% | +11.41% |

💡 Interpreting the Results

- Downside Cushioning: PBFR shows stronger resilience in market declines due to its larger 20% buffer. In a -20% scenario, PBFR is estimated to lose only -5.89%, while BUFP may lose -12.35% with its smaller 12% buffer. This is less than the advertised buffer, but that is because the sub funds are not at the beginning of their outcome period and the market has declined since the buffers were established so not all of the buffer is still available to cushion the blow of a downturn in the market.

- Upside Participation: BUFP provides more upside potential in rallies because higher caps typically accompany smaller buffers. In a +20% scenario, BUFP could return +14.6%, compared to +11.4% for PBFR.

- Positive Returns Even in a Flat Market: Both funds show gains even if the S&P 500 remains flat. This is largely due to recent market declines. Many of the sub-funds are currently sitting below their initial levels — meaning their buffers haven’t been fully used yet. As the funds reach the end of their outcome period, these sub-funds will “catch up” to their starting values by the end of their outcome periods, delivering positive returns even without further market gains.

🧭 What If You Buy Now?

One important nuance:

If you purchase a laddered buffer ETF today, you don’t get the full 12% or 20% downside protection from current levels — because many sub-funds have already used part of their buffer due to the recent market decline.

However, the flip side is that you can earn returns as the buffers realize the full protection at the end of the outcome period. Sub-funds currently below their starting points will still pay off up to their cap as long as the market doesn’t fall further. In this way, the buffer “catching up” becomes a source of return, creating a tailwind even in a flat market.

🔍 Why This Analysis Matters

Many investors look at historical returns or average cap levels when evaluating buffer ETFs. But by modeling performance based on the current structure of each underlying ETF and adjusting for different return scenarios, we gain a much clearer view of potential outcomes.

This is especially helpful when deciding:

- How much protection you’re actually getting right now

- Whether the fund is likely to recover value already lost in prior months

- How the structure might behave if the market declines further or rebounds sharply

So rather than asking “is this fund defensive right now?” a better question is:

Does the current structure position the fund for the level of protection and potential upside that I am looking for?

✅ Conclusion

In a market environment characterized by uncertainty, volatility, and rapid swings in sentiment, laddered buffer ETFs offer an appealing middle ground between fully exposed equity strategies and complex hedging approaches.

Funds like BUFP (12% buffer) and PBFR (20% buffer) are designed to provide structured downside protection with defined upside participation, making them a compelling choice for investors who want to stay in the market while reducing tail risk.

But as we’ve seen, the real value of these funds — and their actual risk/reward profile — depends heavily on the current positioning of their 12 underlying sub-funds. After a significant market decline, for example, the full buffer may no longer be available. Yet this also creates an opportunity: many sub-funds are sitting below their start levels and can “catch up,” generating positive returns even in a flat market.

This scenario-based approach provides clarity on:

- How much real protection you’re getting right now

- Whether the fund is better positioned for recovery or caution

- How the structure compares to other defensive strategies like low-volatility funds or custom hedges

Laddered buffer ETFs are not just passive tools — they are dynamic portfolios that reflect market history and structure in real time. Understanding what’s inside them today is key to setting realistic expectations for tomorrow.

If you’re evaluating how to integrate these funds into your portfolio — or considering when to rotate between different levels of buffer or cap — I’m happy to help you model scenarios or build a tracking framework tailored to your goals.

One response to “Can Buffer ETFs Protect You in a Down Market? PGIM Fund Review”

-

Nicely done.

Leave a Reply