The Tax Cuts and Jobs Act (TCJA) is set to expire at the end of 2025. If Congress doesn’t act, many of the tax reforms that have defined the last decade — including lower brackets, a larger standard deduction, and expanded tax credits — will sunset. Tax rules will revert to their pre-2018 form starting in 2026.

As of now, the outlook for extending the TCJA remains highly uncertain. While Republicans support making the tax cuts permanent, internal divisions and Democratic opposition over cost and fairness have stalled progress. With a narrow GOP majority and no bipartisan consensus, many experts believe there’s a real chance that key TCJA provisions will be allowed to expire.

⚖️ Who Might Fare Better or Worse if the TCJA Expires?

✅ Potential Winners:

- Families with multiple dependents: The return of personal exemptions (~$5,830 per person) could help offset other lost benefits.

- High-income itemizers: The repeal of the $10,000 SALT cap could significantly increase deductible expenses.

❌ Likely Losers:

- Families with children: The Child Tax Credit reverts from $2,000 to $1,000 per child and phases out at lower income thresholds.

- High-income households with limited deductions: May see higher effective tax rates without benefiting from restored exemptions.

- ACA subsidy recipients near the income cliff: Families just over 400% of the Federal Poverty Level (about $120,000 for a family of four) could lose up to $10,000 in premium support if ACA enhancements expire.

🔺 Key TCJA Expiration Changes That Could Increase Taxes:

- Reduced standard deductions

- Elimination of the QBI deduction

- Stricter phaseout thresholds for credits

- Tax bracket thresholds shrink and marginal rates increase

- ACA subsidies may be lost for households just over income limits

🔻 Changes That Could Reduce Taxes:

- Return of personal exemptions (~$5,830/person)

- SALT cap repeal, restoring full deductibility of state and local taxes

- Restoration of miscellaneous itemized deductions

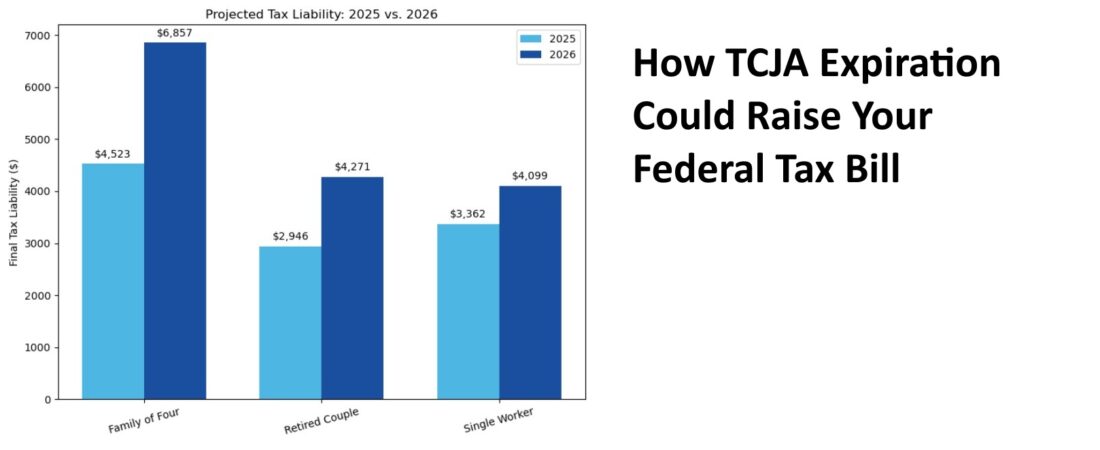

🧾 Real-World Examples: 2025 vs. 2026

To illustrate the impact, I analyzed three representative households using inflation-adjusted assumptions for 2026 assuming the standard deduction for a single filer will be 8,309 and for a joint filers $16,618:

- A Single Worker earning $45K/year

- A Family of Four earning $105K/year

- A Retired Couple with $40K from IRA and $45K from Social Security

These shifts range from a ~$737 increase for the single worker to more than $2,300 for the family of four. The causes vary — smaller deductions, higher marginal rates, lower credits — and the changes impact households differently based on income, size, and how they file.

💬 Additional Considerations

While most will pay more under the post-TCJA system, some could benefit. For example, those living in high-tax states like California, New York, or New Jersey may see a significant deduction boost if the SALT cap is repealed. However, this benefit could be offset by the Alternative Minimum Tax (AMT), which is more likely to affect upper-middle-income households once personal exemptions and large deductions return.

Meanwhile, families relying on Affordable Care Act (ACA) subsidies face a different risk. If income exceeds 400% of the Federal Poverty Level, they could lose all premium support — adding $8,000 to $10,000 or more in annual healthcare costs, depending on their state and coverage.

Some Good references on the topic of TCJA

Tax Foundation – 2026 Tax Brackets if TCJA Expires

A detailed projection of how tax brackets would shift if the TCJA sunsets as scheduled.

Tax Policy Center – 2025 Tax Cuts Tracker

Nonpartisan overview of tax proposals and the expiring TCJA provisions.

Congressional Research Service – Expiring Provisions in the TCJA

A legislative brief outlining key elements of the TCJA that are set to expire.

White House CEA – Economic Impact of Extending TCJA Provisions

An analysis of how extending TCJA provisions could affect the U.S. economy.

Journal of Accountancy – Proposed TCJA Extensions and Tax Changes

A professional summary of current legislative efforts related to TCJA extensions.

🧪 Want to Run Your Own Tax Analysis?

I’ve built a tax estimation tool on MyMoneyToolbox.com that lets you:

- Model your Effective Marginal Tax Rate and total tax across scenarios

- Compare multiple cases side by side

- Currently supports tax years 2023 to 2025 and five states, with more coming soon

🔄 Coming Soon: 2026 Policy Analysis + Roth Conversion Optimizer

I’m also building the most comprehensive Roth conversion simulator available online, designed for:

- Multi-year conversion modeling

- Bracket optimization

- IRMAA and ACA-aware strategies

Other work in progress:

- Support for testing TCJA expiration against policy alternatives

- Expanded state-level analysis tools

🔗 If you want to understand how expiring tax laws, ACA cliffs, or retirement strategies could impact your finances — this is the time to plan ahead.

#TaxPlanning #TCJA #FinancialLiteracy #RothConversion #ACA #TaxReform #MyMoneyToolbox

Leave a Reply