The U.S. tax code is full of contradictions, but few are as absurd—or as damaging—as the so-called cliff effects. These are moments where earning just a few extra dollars can cause your taxes or benefit losses to spike so sharply that your net income actually drops.

With the new 2025 House tax proposal—nicknamed the “Big Beautiful” bill by supporters—these cliffs aren’t just still around. In some cases, they’re worse.

This blog does not take a position for or against the idea of exempting overtime or tip income from taxation. The focus here is on tax policy design—specifically, the importance of avoiding poorly structured rules that create harmful cliff effects or extreme marginal tax rates. Whether or not certain types of income should be taxed, the rules must be predictable, fair, and free from traps that penalize families for working more.

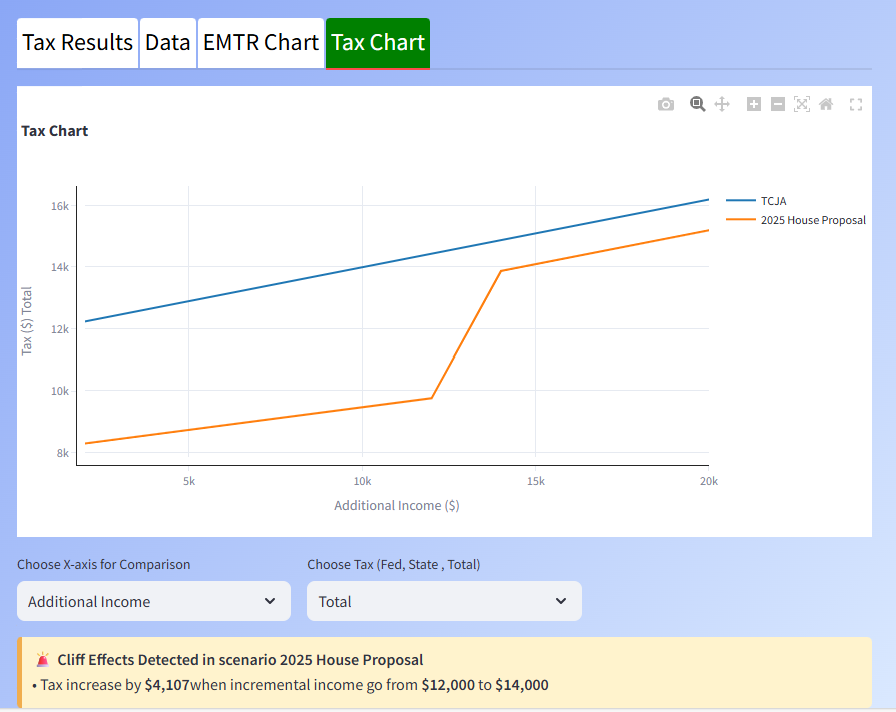

Take the scenario below, modeled using our tax calculator:

🔍 Scenario Summary:

- Filing status: Married filing jointly

- Children: 2 (Household of 4)

- Income: Primary filer earns $150,000 (includes $20,000 overtime)

- Analysis: What happens as the primary filer picks up more overtime?

🚧 The Overtime Cliff – And the Misleading Promise of “No Tax on Overtime”

At first glance, the 2025 House proposal appears generous. With its “no tax on overtime” provision, families working extra hours seem to benefit—taking home more without paying more.

But that’s not entirely true.

Even before the cliff, the chart shows taxes gradually increasing as more overtime is earned. Why? Because under the proposal, only the premium portion of overtime pay is excluded from taxation—not the full amount.

For example, if your regular rate is $50/hour and your overtime rate is $75/hour, only the extra $25/hour is excluded from federal income tax. The base $50/hour is still taxed like regular wages.

So despite the name, “no tax on overtime” doesn’t mean there’s zero federal tax on overtime pay—it’s really a partial exemption, not a blanket exclusion. In addition, Social Security and Medicare tax gets charged on the full amount.

📉Then comes the real problem, the cliff:

When the household’s additional income increases from $12,000 to $14,000, total tax jumps by $4,107—a marginal rate of over 200%. This is triggered by losing the overtime exclusion entirely once income crosses the $160,000 threshold.

That abrupt phaseout creates a cliff effect—where a modest increase in income results in a disproportionately large increase in taxes.

📊 And What About the Gap That Remains?

Even after the cliff, total taxes under the 2025 proposal remain slightly lower than under current law (TCJA). That’s thanks to the expanded Child Tax Credit, which still applies and helps offset some of the lost overtime benefit.

Most people will not be impacted by the cliff as teh majority of people earning overtime pay makes less than $160k per year but for the people impacted it can come as a surprice and it is just simply bad design of the tax code.

🏥 This Isn’t Just About Federal Taxes: ACA Subsidy Cliffs Still Exist

If the tax cliff isn’t bad enough, health insurance adds more fuel to the fire. The Affordable Care Act (ACA) premium subsidies still include a hard cutoff:

- Once your income exceeds 400% of the federal poverty level, you lose all premium subsidies.

- For a family of four, that’s roughly $120,000 in 2025.

- Cross that line by even $1, and your insurance premiums may spike by close to $10,000.

For middle-class families, that’s not just unfair—it’s a deterrent to working harder or accepting a raise.

🎯 Why This Matters

Cliffs like these:

- Discourage work right when families try to get ahead as when you hit the cliff making more money can leave you with less money left after taxes.

- Create unpredictable outcomes, especially for hourly workers with fluctuating income.

- Undermine trust in a system that should be transparent and consistent.

And yet, they persist—because they’re politically expedient. Cliffs allow lawmakers to “target” benefits narrowly and claim fiscal responsibility, without owning the harsh tradeoffs.

🧠 Policy Should Be Smarter

A fair tax code should:

- Phase out credits gradually, never all at once.

- Avoid creating favored classes of income that complicates the tax code and creates unintended consequences.

- Integrate federal and ACA benefit structures so families aren’t hit from multiple directions with disproportionate cuts in subsidies.

Policymakers have tools and real-world data at their disposal. There’s no excuse for policy design that can result in over 100% marginal tax rates.

🧾 Want to See How This Affects You?

This analysis was powered by a custom-built Tax Calculator App that lets you estimate your taxes under:

- Current tax law

- The 2026 scenario where the TCJA expires

- The 2025 or 2026 scenario if the House bill is enacted.

You can:

- Input your own income, deductions, and family structure

- Model the impact of additional income on your tax bill from overtime, regular income, investments or IRA distributions.

- Compare scenarios side-by-side

- Spot cliff effects before they surprise you at tax time

- This app is still under development, so the number of concurrent users are limited as I work on making the code more scalable.

🔗 Try it out here: Tax Estimator (Beta testing version) | My Money Toolbox

Leave a Reply